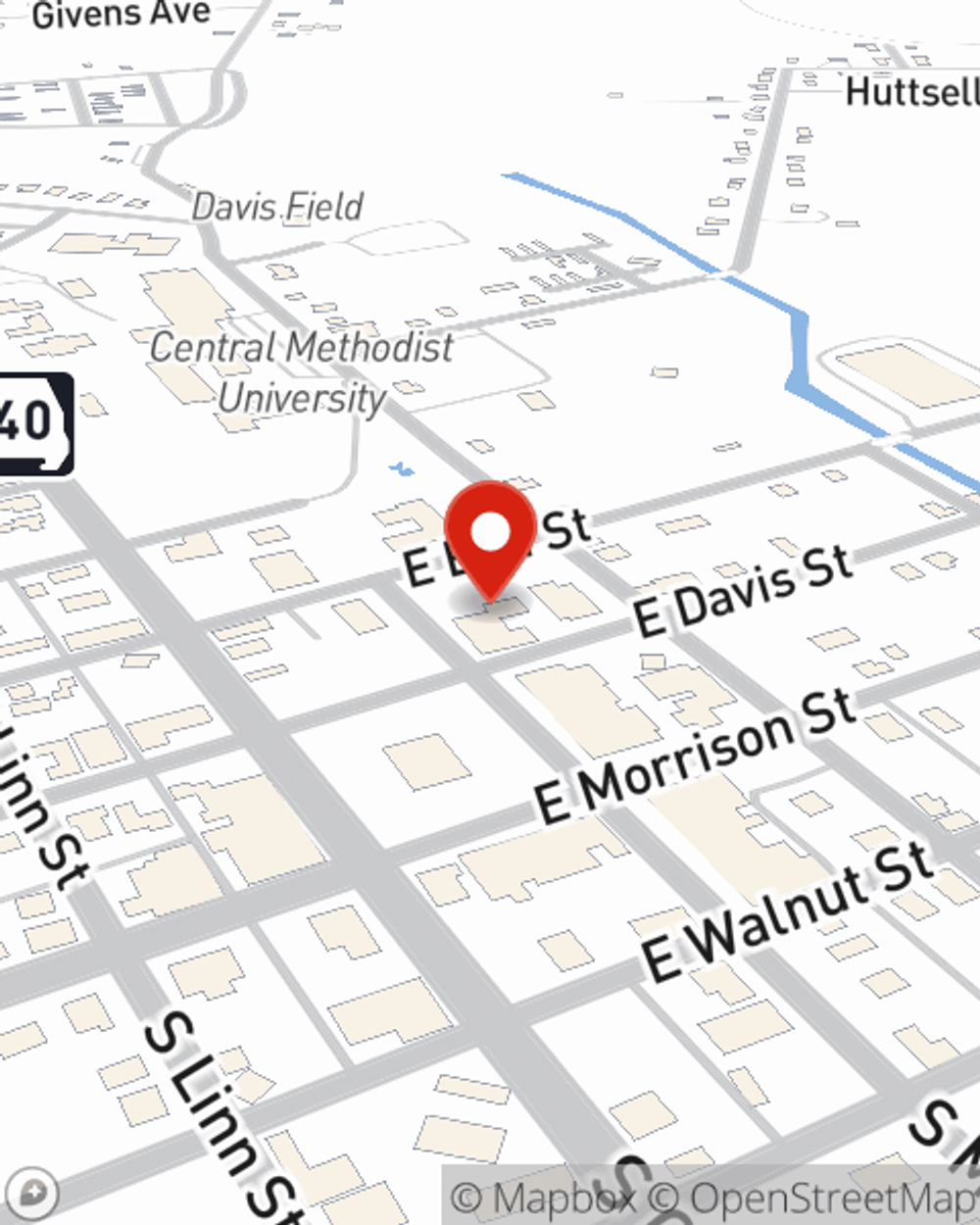

Business Insurance in and around Fayette

Fayette! Look no further for small business insurance.

Cover all the bases for your small business

Your Search For Remarkable Small Business Insurance Ends Now.

Whether you own a a fabric store, a photography business, or a hair salon, State Farm has small business insurance that can help. That way, amid all the different moving pieces and options, you can focus on making this adventure a success.

Fayette! Look no further for small business insurance.

Cover all the bases for your small business

Strictly Business With State Farm

When one is as dedicated to their small business as you are, it is understandable to want to make sure everything is in order. That's why State Farm has coverage options for surety and fidelity bonds, commercial liability umbrella policies, worker’s compensation, and more.

Since 1935, State Farm has helped small businesses manage risk. Reach out to agent Landon Ball's team to learn about the options specifically available to you!

Simple Insights®

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

Top reasons to add an accessory dwelling unit to your home

Top reasons to add an accessory dwelling unit to your home

Look at the rising trend of accessory dwelling units and check out tips to help you decide if one of these small homes is right for your big plans.

Landon Ball

State Farm® Insurance AgentSimple Insights®

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

Top reasons to add an accessory dwelling unit to your home

Top reasons to add an accessory dwelling unit to your home

Look at the rising trend of accessory dwelling units and check out tips to help you decide if one of these small homes is right for your big plans.