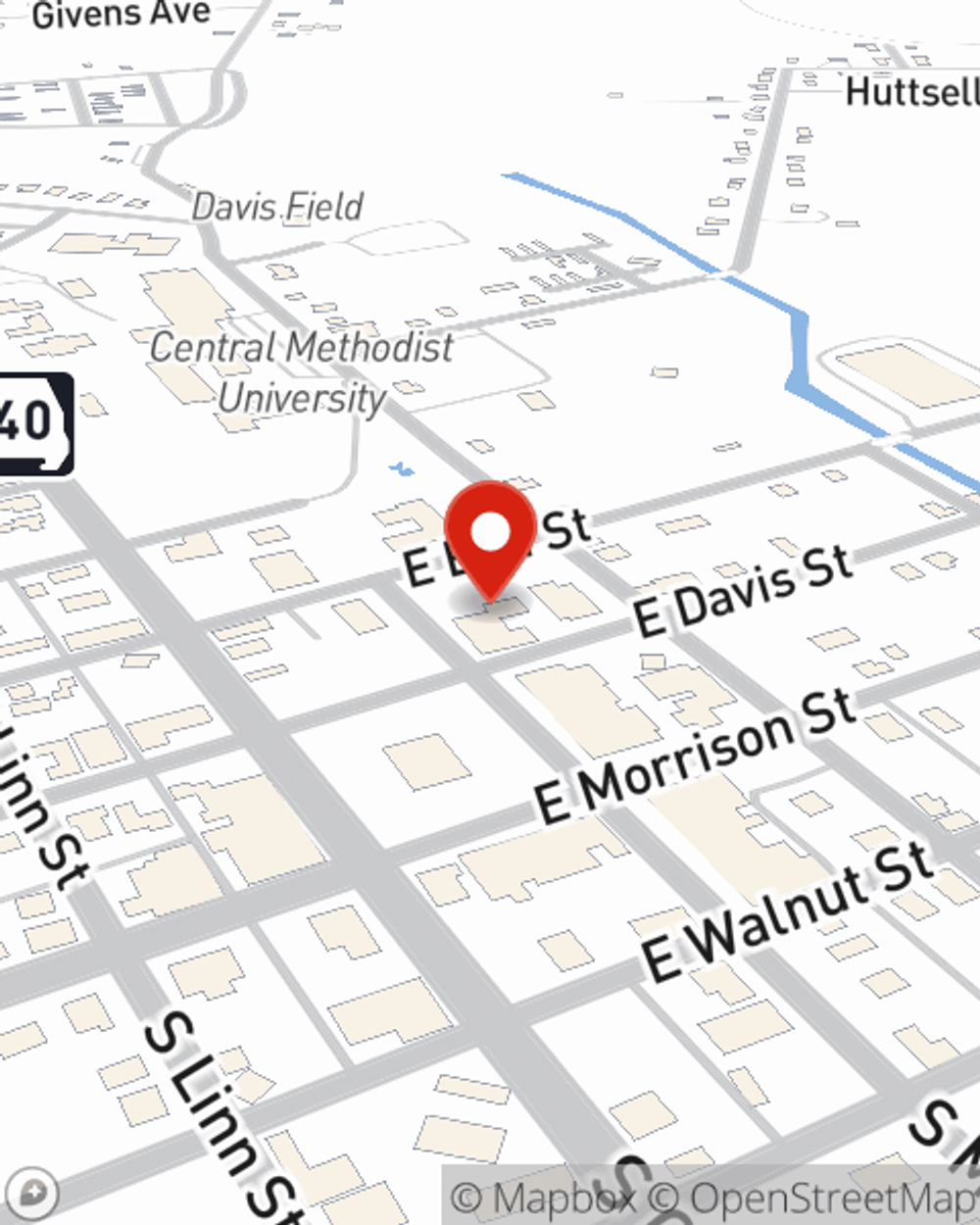

Renters Insurance in and around Fayette

Welcome, home & apartment renters of Fayette!

Rent wisely with insurance from State Farm

Would you like to create a personalized renters quote?

There’s No Place Like Home

It may feel like a lot to think through keeping up with friends, your sand volleyball league, family events, as well as deductibles and savings options for renters insurance. State Farm offers no-nonsense assistance and unmatched coverage for your home gadgets, souvenirs and mementos in your rented space. When trouble knocks on your door, State Farm can help.

Welcome, home & apartment renters of Fayette!

Rent wisely with insurance from State Farm

Why Renters In Fayette Choose State Farm

You may be doubtful that you really need Renters insurance, but what many renters don't know is that your landlord's insurance generally only covers the structure of the townhome. What it would cost to replace your valuables can be substantial. With State Farm's Renters insurance, you have a good neighbor who can help when windstorms or tornadoes occur.

If you're looking for a value-driven provider that offers a free quote on a renters policy, reach out to State Farm agent Landon Ball today.

Have More Questions About Renters Insurance?

Call Landon at (660) 248-2424 or visit our FAQ page.

Simple Insights®

Compare different types of mortgages

Compare different types of mortgages

Knowing the different types of mortgages can be confusing. Learn the different mortgage types and determine what may work best for you.

What is an e-bike?

What is an e-bike?

If you’re wondering what sets an e-bike apart from a regular bike or want details on e-bike insurance, read on for the answers to these questions and more.

Landon Ball

State Farm® Insurance AgentSimple Insights®

Compare different types of mortgages

Compare different types of mortgages

Knowing the different types of mortgages can be confusing. Learn the different mortgage types and determine what may work best for you.

What is an e-bike?

What is an e-bike?

If you’re wondering what sets an e-bike apart from a regular bike or want details on e-bike insurance, read on for the answers to these questions and more.